Introduction

Bangalore’s fintech ecosystem is flourishing, with innovative startups disrupting traditional financial services. However, this growth comes with the responsibility of navigating India’s complex regulatory landscape, particularly the Reserve Bank of India (RBI) guidelines.

As a leading fintech lawyer Bangalore expert, SP Law Chambers has witnessed firsthand how non-compliance can derail promising ventures. This comprehensive guide demystifies fintech compliance for Bangalore startups, covering everything from digital lending regulations to KYC norms, payment aggregator licensing, and data privacy requirements.

Whether you’re launching a payments’ app, peer-to-peer lending platform, or digital banking service, this checklist will help you stay compliant while scaling your business in India’s fintech capital.

Why Bangalore Startups Need Specialized Fintech Compliance

The Rise of Fintech in Bangalore

Bangalore has rightfully earned its reputation as India’s fintech hub, hosting approximately 60% of the country’s fintech startups. This concentration of innovation creates unique regulatory challenges that require specialized expertise.

The city’s dynamic startup ecosystem, coupled with RBI’s evolving regulatory framework, makes local legal knowledge indispensable. A specialized fintech lawyer Bangalore understands not just the national regulations but also city-specific nuances and enforcement patterns.

For instance, RBI’s 2024 framework updates have particular implications for Bangalore-based startups operating in digital payments and lending spaces.

With new technologies emerging rapidly, having legal counsel who stays abreast of regulatory changes is no longer optional but essential for sustainable growth.

Key Fintech Startup Statistics in Bangalore

Risks of Non-Compliance

The consequences of non-compliance with RBI regulations can be severe, ranging from financial penalties to operational restrictions. Recent RBI guidelines stipulate penalties that can reach up to ₹1 crore for violations, not to mention potential criminal liability in cases of deliberate non-compliance.

Beyond financial repercussions, regulatory breaches can damage a startup’s reputation, deter investors, and even lead to operational shutdowns. SP Law Chambers, as a trusted fintech compliance services Bangalore provider, has helped numerous startups avoid these pitfalls through proactive compliance strategies.

Our experience shows that investing in compliance from the outset is far more cost-effective than addressing violations after they occur. In Bangalore’s competitive fintech landscape, where investor scrutiny is high, demonstrating robust compliance practices can be a significant competitive advantage.

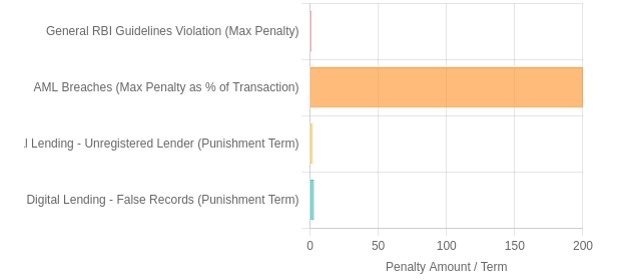

Potential Financial Penalties for Fintech Non-Compliance

Key RBI Regulations Every Bangalore Fintech Startup Must Know

RBI’s 2024 Framework for Fintech

The RBI’s 2024 framework represents a significant evolution in fintech regulation, introducing stricter requirements across multiple domains. One notable update is the enhanced data localization norms for payment aggregators, requiring certain customer data to be stored within India’s borders.

These changes reflect RBI’s growing emphasis on data security and sovereignty in the digital financial ecosystem. SP Law Chambers’ fintech lawyer Bangalore team has meticulously analyzed these updates and translated them into actionable compliance strategies for our clients.

The framework also introduces new governance requirements for fintech companies, including mandatory board-level oversight of compliance functions.

For Bangalore startups operating in cross-border payments or international remittances, these changes have particular implications that require specialized legal interpretation.

Digital Lending Laws

Digital lending has emerged as one of the fastest-growing segments in Bangalore’s fintech landscape, but it also faces some of the most stringent regulatory oversight.

RBI’s recent norms have capped interest rates on digital loans and mandated transparent disclosures about all charges and fees. The regulations also prohibit the use of unfair recovery practices and require lenders to establish grievance redressal mechanisms.

Our digital lending legal advisor Bangalore services help startups navigate these requirements while maintaining competitive business models. The guidelines specifically address issues like “rent-an-NBFC” arrangements, where fintech companies partner with non-banking financial companies to bypass licensing requirements.

SP Law Chambers assists clients in structuring compliant digital lending operations that align with both RBI regulations and business objectives.

Digital Lending Compliance: A Bangalore Startup’s Checklist

1: Entity Structuring

- Choose the Right Legal Structure: Decide between becoming an NBFC, a P2P lender, or partnering with a bank. Each structure has different RBI requirements.

- Registration and Licensing: Register your entity under the Companies Act and apply for necessary licenses (e.g., NBFC registration from RBI if applicable).

- Compliance with State Laws: Ensure compliance with Karnataka’s money-lending laws if operating a P2P or lending platform.

2: KYC & AML Implementation

- Implement KYC Procedures: Set up e-KYC using Aadhaar APIs and video-based KYC for high-risk customers as per RBI guidelines.

- AML and CFT Measures: Establish anti-money laundering controls, customer due diligence, and reporting mechanisms to prevent financial crimes.

- Regular Audits: Conduct periodic KYC/AML audits to ensure ongoing compliance. SP Law Chambers’ fintech compliance services in Bangalore include KYC audits.

3: Loan Agreement Drafting

- Draft Compliant Loan Agreements: Ensure all loan terms, interest rates, fees, and repayment schedules are clearly stated and compliant with RBI rules. Avoid predatory lending practices.

- Transparent Disclosures: Provide borrowers with a key fact statement and disclose all charges upfront, as mandated by the digital lending guidelines.

- Avoid Regulatory Arbitrage: Steer clear of “rent-an-NBFC” arrangements that try to bypass regulations. SP Law Chambers’ fintech lawyers in Bangalore draft contracts that keep you on the right side of the law.

KYC & AML Compliance for Fintech Companies in Bangalore

RBI’s KYC Guidelines for Startups

The RBI has established comprehensive KYC guidelines specifically tailored for fintech companies, recognizing the unique challenges of digital identity verification.

One key requirement is the implementation of video-based KYC for high-risk customers and those unable to complete in-person verification. Our digital lending legal advisor Bangalore services help startups design and implement these processes efficiently while maintaining compliance.

The guidelines also emphasize the importance of ongoing customer due diligence, requiring periodic updates of customer information based on risk assessment.

SP Law Chambers assists Bangalore fintech companies in developing risk-based KYC frameworks that balance regulatory requirements with operational efficiency. We provide templates and implementation guides to streamline the KYC process while ensuring full compliance with RBI norms.

AML Penalties and Prevention

Anti-Money Laundering (AML) violations can result in severe penalties for fintech companies, with fines potentially reaching 200% of the transaction value in serious cases. Bangalore’s position as a financial hub makes fintech startups particularly susceptible to money laundering risks, requiring robust prevention measures.

SP Law Chambers’ fintech compliance services Bangalore include comprehensive risk assessments and AML program development to help clients mitigate these risks. Our approach combines regulatory expertise with practical implementation support, ensuring that compliance measures are both effective and scalable.

We assist clients in developing transaction monitoring systems, establishing suspicious activity reporting protocols, and conducting regular AML audits. By partnering with SP Law Chambers, Bangalore fintech startups can demonstrate to regulators and investors alike their commitment to preventing financial crimes.

Payment Gateway & Aggregator Licensing Process in India

RBI Licensing Requirements

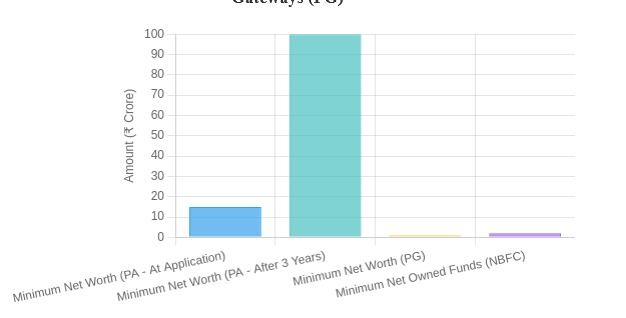

Operating as a payment gateway or aggregator in India requires specific RBI licenses, each with distinct eligibility criteria and compliance requirements. Payment aggregators must maintain a minimum net worth of ₹15 crore, while payment system operators need ₹100 crore.

The application process is complex, requiring detailed documentation about business models, technology infrastructure, and compliance frameworks.

A fintech lawyer Bangalore from SP Law Chambers navigates these requirements efficiently, helping clients prepare comprehensive applications that address regulatory concerns.

Beyond the initial licensing, payment aggregators must also establish robust fraud prevention mechanisms, customer grievance redressal systems, and data security protocols. Our team has extensive experience helping Bangalore-based fintech companies secure these licenses and maintain ongoing compliance.

Bangalore-Specific Compliance

While RBI regulations apply nationwide, Bangalore’s status as a financial hub creates additional compliance considerations. Local liaising with RBI’s Bangalore office is often necessary for licensing and ongoing compliance matters.

SP Law Chambers, as a top fintech compliance services Bangalore provider, has established relationships with regulatory authorities and understands local enforcement patterns.

Bangalore-based payment aggregators must also consider the city’s high concentration of tech talent and startups, which can create unique cybersecurity challenges.

Our compliance strategies address these local factors while maintaining alignment with national regulatory requirements. We help clients navigate inspections, respond to regulatory queries, and implement compliance measures that resonate with Bangalore’s specific business environment.

Data Privacy Compliance Under DPDP Act for Fintech

New DPDP Act Implications

The Digital Personal Data Protection Act (DPDP) 2023 imposes strict obligations on fintech companies handling personal data. Startups must obtain user consent, allow data portability, and conduct data protection impact assessments. Non-compliance can result in significant penalties. Our fintech lawyers in Bangalore ensure your business meets these new requirements with proper consent management and data audit protocols.

Cybersecurity Best Practices

Fintechs must protect customer data from breaches. Implement cybersecurity measures such as encryption, multi-factor authentication, and regular security audits. Achieving certifications like ISO 27001 can demonstrate your commitment to security. SP Law Chambers’ digital lending legal advisors in Bangalore offer cybersecurity compliance reviews to help fortify your systems.

Common Compliance Mistakes Bangalore Startups Make

Ignoring RBI Circular Updates

RBI frequently issues circulars and guidelines that update existing regulations or introduce new requirements. Bangalore fintech startups often struggle to keep pace with these updates, leading to unintentional violations.

Our fintech compliance services Bangalore include monitoring regulatory changes and providing timely updates to clients. We’ve observed that many startups miss quarterly regulatory updates, which can result in compliance gaps.

SP Law Chambers addresses this challenge through our compliance monitoring service, which tracks regulatory developments and assesses their impact on clients’ operations.

This proactive approach helps Bangalore startups maintain compliance without diverting valuable resources from core business activities.

Overlooking State Regulations

While RBI regulations dominate fintech compliance, state-level laws also apply to certain fintech business models. Karnataka’s money-lending laws, for example, have specific implications for peer-to-peer lending platforms operating in Bangalore.

SP Law Chambers’ fintech lawyer Bangalore team provides comprehensive advice on multi-layer compliance, addressing both central and state regulatory requirements.

Many Bangalore startups focus exclusively on RBI guidelines while overlooking state-specific registration requirements or licensing obligations. This oversight can lead to regulatory surprises and potential penalties.

Our approach integrates compliance at all governmental levels, ensuring that fintech operations remain seamless across different jurisdictions.

Step-by-Step Compliance Checklist for Fintech Startups

Pre-Launch Checklist

Before launching your fintech product in Bangalore, ensure you’ve addressed these critical compliance elements:

- Entity registration: Choose the appropriate legal structure (private limited, LLP, etc.) based on your business model and regulatory requirements.

- RBI license application: Begin the licensing process well in advance, as it typically takes 3-6 months for approval.

- KYC framework setup: Design and implement a robust identity verification process that meets RBI requirements.

- Data security measures: Establish baseline cybersecurity protocols and work towards ISO 27001 certification.

- Compliance team: Designate a compliance officer responsible for regulatory adherence.

SP Law Chambers’ fintech lawyer Bangalore team provides templates and implementation support for each of these elements, helping startups launch with confidence. Our experience shows that addressing compliance requirements during the development phase is far more efficient than retrofitting after launch.

Post-Launch Compliance

Maintaining compliance requires ongoing attention and resources. Key post-launch compliance activities for Bangalore fintech startups include:

- Quarterly regulatory filings: Submit required reports to RBI and other regulators on time.

- Annual data audits: Conduct comprehensive reviews of data handling practices and security measures.

- Regular compliance training: Ensure all employees understand their compliance responsibilities.

- Incident response planning: Prepare for potential security breaches or regulatory inquiries.

- Contract reviews: Regularly update user agreements and service contracts to reflect regulatory changes.

Our fintech compliance services Bangalore ensure that startups maintain adherence to these requirements while scaling their operations. By establishing compliance as an ongoing process rather than a one-time project, Bangalore fintech companies can focus on innovation without regulatory distractions.

How SP Law Chambers Helps Bangalore Startups Stay Compliant

Our Bangalore-Centric Approach

At SP Law Chambers, we combine national regulatory expertise with deep knowledge of Bangalore’s fintech ecosystem. As a leading fintech lawyer Bangalore, we offer services specifically tailored to the city’s startup environment. Our Bangalore-centric approach includes:

- RBI liaisoning: Direct communication with regulatory authorities to address concerns and expedite processes.

- Compliance automation tools: Technology solutions that streamline compliance monitoring and reporting.

- Local regulatory insights: Understanding of enforcement patterns and priorities specific to Bangalore.

- Startup-friendly pricing: Flexible engagement models that accommodate early-stage companies’ budgets.

- Multilingual support: Services available in English, Hindi, Kannada, Tamil, and Telugu to serve Bangalore’s diverse startup community.

Our team has successfully guided over 1500+ clients through complex compliance challenges, establishing SP Law Chambers as a trusted partner for Bangalore’s fintech innovators.

Transparent Pricing

We believe that compliance should be accessible to all startups, regardless of size or budget. SP Law Chambers offers transparent pricing models with fixed-fee packages for fintech compliance services.

Our digital lending legal advisor Bangalore services start at ₹25,000 per month, providing comprehensive compliance support without unexpected costs. This pricing includes regulatory monitoring, compliance updates, and access to our legal resources.

For startups with more complex needs, we offer customized engagement models that scale with your business. By providing clear, upfront pricing, we help Bangalore fintech companies budget effectively for compliance expenses.

Fintech Compliance FAQs Bangalore Startups Must Know

Navigating RBI regulations and compliance requirements can feel overwhelming for Bangalore’s fintech founders. SP Law Chambers, your trusted fintech lawyer Bangalore experts, answers the most pressing questions to help you build with confidence.

Q1. What is the biggest compliance mistake Bangalore fintech startups make?

The most critical error is treating compliance as an afterthought. Many founders focus solely on product development and user acquisition, only addressing regulations when forced by penalties or investor demands.

This reactive approach often leads to costly redesigns, fines, or even shutdowns. Proactive compliance, ideally integrated from day one, is far more efficient and protects your growth trajectory.

Engaging a specialized fintech lawyer Bangalore early helps embed compliance into your core business model, saving significant time and resources later.

Q2. How does RBI’s 2024 framework specifically impact Bangalore-based startups?

RBI’s 2024 updates bring significant changes:

- Stricter Data Localization: Enhanced requirements for storing Indian customer data within India, impacting cross-border services.

- Governance Overhaul: Mandatory board-level compliance oversight, requiring senior management buy-in.

- Enhanced KYC/AML: Tighter norms for digital identity verification and transaction monitoring.

- Digital Lending Caps: Clear interest rate ceilings and stricter disclosure mandates. Bangalore startups, given the city’s high volume of fintech innovation, need a fintech compliance services Bangalore provider who understands how these national rules translate into local operational realities and enforcement priorities.

Q3. Do I need an NBFC license to offer digital loans in Bangalore?

Not always, but it’s complex:

- Direct Lending: If your platform originates loans using its own capital, an NBFC license from RBI is mandatory.

- P2P Lending: Operating as an intermediary connecting lenders and borrowers requires a specific P2P Lending License from RBI.

- “Rent-an-NBFC” Partnerships: Using an NBFC partner without proper due diligence and clear agreements violates RBI norms and is risky. A digital lending legal advisor Bangalore can help you structure your model compliantly, whether pursuing licensing or forging legitimate partnerships.

Q4. What are the exact KYC requirements for a fintech app in Bangalore?

RBI mandates a layered approach:

- Base KYC: Aadhaar-based e-KYC using UIDAI APIs is the standard minimum.

- Video KYC (V-CIP): Mandatory for customers unable to complete in-person verification or classified as higher risk.

- Ongoing Due Diligence (CDD): Periodic updates and reviews based on customer risk profiles.

- AML Measures: Robust transaction monitoring and Suspicious Transaction Reporting (STR) protocols. Fintech compliance services Bangalore like ours provide frameworks to automate these processes efficiently while ensuring full regulatory adherence.

Q5. How much should I budget for fintech compliance in Bangalore?

Costs vary based on complexity, but expect:

- Initial Setup: Entity structuring, license applications, KYC/AML framework development: ₹50,000 – ₹2,00,000+.

- Ongoing Compliance: Regulatory monitoring, filings, audits, updates: ₹15,000 – ₹50,000+ per month. Packages from firms like SP Law Chambers start at ₹15,000/month for basic monitoring, scaling with needs.

- Specialized Services: Cybersecurity audits, DPDP Act compliance, complex licensing: Additional project fees. View compliance as an investment, not just an expense. A fintech lawyer Bangalore can provide transparent pricing and optimize spend.

Q6. What state laws apply to fintech startups beyond RBI rules in Karnataka?

While RBI is primary, Karnataka regulations matter:

- Karnataka Money Lending Act: Impacts P2P platforms and certain lending models, potentially requiring registration.

- Consumer Protection Act: Governs unfair trade practices, transparent pricing, and grievance redressal – crucial for user-facing fintech.

- IT Act & Karnataka IT Policies: Influence data security and operational setup within the state. A fintech compliance services Bangalore provider ensures you navigate this multi-layer compliance landscape effectively.

Q7. How long does it really take to get an RBI license for a payment aggregator?

While RBI states timelines can vary, realistic expectations are:

- Preparation & Documentation: 1-2 months (meticulous application is key).

- RBI Scrutiny & Queries: 2-4 months (common for additional information requests).

- Overall Process: Typically 3-6 months with a well-prepared application and proactive follow-up. Engaging experienced fintech lawyer Bangalore counsel significantly expedites this by anticipating requirements and liaising effectively with RBI. Delays often stem from incomplete applications or unresolved queries.

Q8. What are the penalties for non-compliance with RBI guidelines?

Penalties are severe and can include:

- Monetary Fines: Can reach up to ₹1 crore for certain violations.

- Interest Rate Penalties: Up to 200% of transaction value for AML breaches.

- Business Restrictions: Cease-and-desist orders, suspension of licenses, or operational curtailments.

- Reputational Damage: Loss of investor confidence and user trust.

- Criminal Liability: In cases of deliberate fraud or serious violations. A digital lending legal advisor Bangalore is essential to mitigate these risks through proactive compliance strategies.

Q9. How does the new DPDP Act affect my fintech startup’s data handling?

The Digital Personal Data Protection (DPDP) Act introduces crucial obligations:

- Lawful Basis: Processing requires clear consent or another lawful basis.

- Notice & Consent: Transparent information about data use and explicit user consent mechanisms.

- Data Minimization & Purpose Limitation: Only collect data necessary for the specified purpose.

- Data Security: Implement robust security measures (ISO 27001 is a strong benchmark).

- Data Breach Notification: Mandatory reporting of significant breaches to authorities and affected individuals. Your fintech lawyer Bangalore must help you redesign data processes to align with these new rules.

Q10. Where can I get reliable, ongoing compliance support in Bangalore?

SP Law Chambers offers dedicated fintech compliance consultation Bangalore tailored for startups:

- Bangalore-Centric Expertise: Deep understanding of local ecosystem and regulatory nuances.

- Proactive Monitoring: Tracking RBI circulars, state laws, and DPDP updates.

- Practical Implementation: Helping translate regulations into operational procedures.

- Transparent Packages: Fixed-fee models starting at ₹15,000/month for essential monitoring and support.

- Multilingual Support: Services available in English, Hindi, Kannada, Tamil, and Telugu. Don’t navigate compliance alone. Partner with experts who speak your language and understand your startup’s journey in India’s fintech capital. Contact SP Law Chambers today for a dedicated fintech compliance consultation Bangalore.

Conclusion

Bangalore’s fintech boom demands proactive compliance. SP Law Chambers, your expert fintech lawyer in Bangalore, simplifies RBI regulations with actionable checklists.

Don’t let compliance hinder growth contact us today for a fintech compliance consultation in Bangalore. Let’s ensure your startup scales successfully while staying on the right side of the law.

Advocate Geethanjali Setty is the driving force behind SP LAW CHAMBERS. With over 14 years of hands-on legal experience, she is known for her ethical, result-oriented approach. Geethanjali is registered with the Bar Council of Karnataka and has built a reputable practice offering comprehensive legal consultancy and advisory services. She and her team of six dedicated advocates handle a wide range of legal matters with integrity and efficiency.

At SP LAW CHAMBERS, clients receive not just legal expertise, but also a commitment to clear, client-focused guidance. Geethanjali’s focus on client satisfaction and her proven track record make her a trusted name in the Bangalore legal community.